“We’ve been tracking equine populations for nearly 40 years now and have a pretty good idea of the status of each breed and the extent that they are endangered.”

Continue reading …Rule Change Makes Registering Cropouts With APHA Easy

March 9, 2015 Comments Off on Rule Change Makes Registering Cropouts With APHA Easy

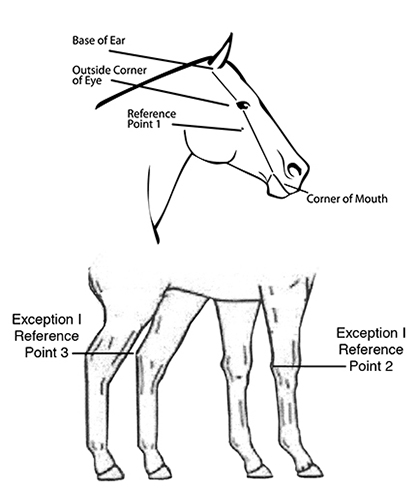

Now to qualify for the Regular Registry, Paints—regardless of lineage—must have a natural Paint marking that extends more than two inches above the center of the knee or hock, or beyond an imaginary line that extends from the base of the ear to the outside corner of the eye to the corner of the mouth and under the chin.

Continue reading …#Fun Friday: A Little Horse Powered Fun on a Snow Day

March 6, 2015 Comments Off on #Fun Friday: A Little Horse Powered Fun on a Snow Day

The 11 second video features Brereton aboard his three-year-old Quarter Horse named “Si” providing a bit of horsepower for fellow cowboy/snowboarder Chase Richter as he “attempts” a jump.

Continue reading …Gearing Up For 2015 Virginia Quarter Horse Classic! Check Out Just Released Showbill and Judges’ List

March 3, 2015 Comments Off on Gearing Up For 2015 Virginia Quarter Horse Classic! Check Out Just Released Showbill and Judges’ List

The Equine Chronicle is proud to be a sponsor of the 2015 Virginia Classic once again this year and will be hosting The Equine Chronicle Exhibitors’ Party just prior to the Hylton Maiden $50,000 3 and Over Western Pleasure. The big event will take place Saturday, April 18th and will be NSBA approved.

Continue reading …Photos and Results From 10th Anniversary of March To The Arch!

March 2, 2015 Comments Off on Photos and Results From 10th Anniversary of March To The Arch!

Everyone’s attention was acutely focused on the stunning display of sequins, spandex, and strategically placed balloons that adorned the characters who participated in the “Ladies and Men’s” Western Pleasure.

Continue reading …$30 Tickets For Cavalia’s Odysseo For EQUESTRIANS ONLY This Weekend!

February 27, 2015 Comments Off on $30 Tickets For Cavalia’s Odysseo For EQUESTRIANS ONLY This Weekend!

Remember earlier this month when we gave our readers a behind-the-scenes look at the incredible theatrical performance known as Cavalia’s Odysseo that’s currently on tour in Frisco, TX?

Continue reading …10th Anniversary of March To The Arch Heating Things Up in Missouri

February 26, 2015 Comments Off on 10th Anniversary of March To The Arch Heating Things Up in Missouri

While the majority of the country is shut in with snow, ice, sleet, and freezing temperatures, things are quickly heating up in Missouri, as the 10th anniversary of the March To The Arch kicks off today in Lake St. Louis.

Continue reading …Dixie National Quarter Horse Show Wraps Up 50th Anniversary Event

February 25, 2015 Comments Off on Dixie National Quarter Horse Show Wraps Up 50th Anniversary Event

The 50th anniversary of the Dixie National Quarter Horse Show just wrapped up February 16-22 in Jackson, MS. Thanks to Emily Peak Photography, we have some fun around the ring photos to share from the #Dixie50.

Continue reading …An Insider’s Look at Blackberry Farm, Cover Location For 2015 Sports Illustrated Swimsuit Issue

February 24, 2015 Comments Off on An Insider’s Look at Blackberry Farm, Cover Location For 2015 Sports Illustrated Swimsuit Issue

When taking a look at the latest cover of the 2015 Sports Illustrated Swimsuit Edition, we noticed something very interesting… Is that a horse paddock fence in the background?

Continue reading …